Adoption of FinTech is gaining momentum worldwide, having grown from 16% in 2015 to 33% in 2017 and 64% in 2019 according to Global FinTech Adoption Index 2019, a recently issued report by advisory firm EY.

EY’s primary research served as the backdrop for a September 26 discussion on global FinTech adoption held at the Federal Reserve Bank of Atlanta and co-sponsored by the Brazilian American Chamber of Commerce Southeast. The lively, interactive two-hour conversation was led by a stellar panel composed of Glen Sarvady, Principal at 154 Advisors; Rodrigo Dantas, Principal at EY; Wayne Johnson, Partner at Welsh Carson, Scott Meyerhoff, CFO at InComm; and Esther Pigg, SVP Product Strategy at FIS.

The morning discussion focused on the dynamics of three specific markets – Brazil, China and the US. Not surprisingly given its reputation, China leads all countries in Consumer FinTech adoption at 87% (actually tied with India) on EY’s scale, well above the global average of 64%. Worldwide, adoption has grown four-fold since 2015, with all countries participating in the upswing.

Specifically in China, money transfer and payment apps are pervasive. Ant Financial’s AliPay may generate of only 0.2-0.6% per transaction amount (far lower than US card issuers), but the company realizes additional value from the relationships and data in terms of how their customers shop, handle money and pay debts. In 2018, Ant facilitated more than $8 trillion in transactions.

Brazil’s adoption is in line with the global average. Panelists stated that Brazil has often been called the country of the future, and FinTech might become the segment where the country showcases its capabilities to a global audience. Brazil is a great place to test sophisticated solutions at small scale, and mass-market solutions at large scale.

There are structural reasons for the US trailing the global average, and many can be read as positives. The financial services market benefits from established solutions that work quite well, the number of unbanked consumers is lower, and consumers are generally less trusting of privacy and security with startups. Also complicating the picture is that the US has roughly 11,000 financial institutions – compared to four major banks in China that control 86% of volume – and four major credit card companies in the US that must be coordinated in launching new solutions.

In terms of awareness the numbers are much higher – 96% of consumers globally know of at least one FinTech service. There seems to be two types of Fintech offerings: one which disrupts an existing incumbent service (such as auto insurance) by offering lower prices or a more compelling set of capabilities; the other is an entirely new service offered due to enhancements in technology or business models (such as peer-to-peer lending). The next growth opportunities for FinTech are in segments where adoption is low such as consumers in rural areas, consumers with minimal education, and women.

Note that part of the reason for the strong adoption worldwide is that incumbent organizations have also started to offer FinTech products. As many as two-thirds of consumers have stated they would turn first to their current bank or insurer when considering a new financial service.

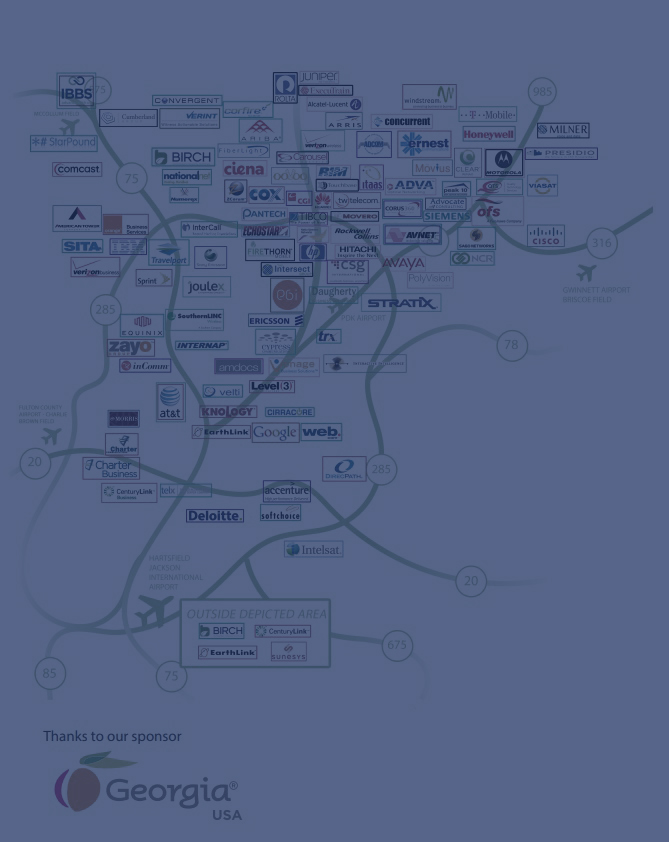

The panel discussed that competition is coming not only from the financial industry but also from new players from other industries such as retail, social media, telecommunications, and utilities. These new entrants have developed fast, frictionless, cost-effective platforms for their traditional segments and are now looking to modify them to handle financial transactions. Increased acceptance of “open banking” models and enablement of third-party applications on traditional banks’ infrastructure could speed their adoption. Solving key problems around security by leveraging new technologies such as artificial intelligence and behavioral analytics is another opportunity.

The panel concluded that all this activity and innovation may turn out to be a good thing as it offers more choices for consumers.