Everyone I have spoken with this week is buzzing about Libra. My parents are in Dublin, Ireland on a college-sponsored trip and I received a text from my Mom on Wednesday asking what I thought about Libra! Clearly there’s hope for payments experts like me that our families may yet figure out what we do for a living.

If you are just coming up to speed on the news – like the rest of us, since details remain fairly scarce – here are a few basics.

Point 1: Libra is the name of Facebook’s planned digital currency. Designed as a ‘stablecoin’ – meaning its value is pegged to a basket of mature fiat currencies – its value should not fluctuate significantly daily or hourly like Bitcoin or Ether. This also means that a technology company will need permission to hold reserves at The Bank of England, the US Federal Reserve, and other central bank issuers of fiat currencies to which Libra will be pegged.

Point 2: Facebook has created a subsidiary legal entity called Calibra, which will administer the currency. Presumably this means different terms and conditions will govern Calibra’s customer relations than those between Facebook and the customer. Facebook has indicated the data rights will be different and that it will not use information from Libra transactions to enhance its core advertising business.

Point 3: Calibra is also the name of Facebook’s digital wallet for the currency, which will reside within WhatsApp and Messenger, as well as existing as a stand-alone app.

Point 4: Facebook has enlisted 27 partners – with the intent to add more – to found the Libra Association, giving a degree of independence to governance of the currency. The list of participants is impressive – household names like Visa, Mastercard and PayPal provide financial services credibility while digital economy leaders Uber, Spotify and Lyft hint at logical uses for the currency.

Overall, this initiative is amazing because of its global scope and the fact that Facebook has access to over 1.5 billion daily active users – also known as one-third of our planet’s population. Libra seems to attempt to balance the significant opportunity for disruption of the payments landscape in mature markets with the promise of meaningful financial inclusion for the world’s 1.7 billion people without access to bank accounts.

On the other hand, IMF head Christine Lagarde recently foreshadowed regulatory concerns with the approach in her comments from the G20 seminar in Japan in early June.

“A significant disruption to the financial landscape is likely to come from the big tech firms, who will use their enormous customer bases and deep pockets to offer financial products based on big data and artificial intelligence.

These developments hold out the promise of accelerating inclusion and modernizing financial markets, but raise, in addition to privacy issues, competition and market concentration concerns, both of which could lead to vulnerabilities in the financial system.”

And since Libra’s announcement, the Bank of England Governor Mark Carney said that BOE would open consultation on whether to permit nonbank providers (e.g., Libra) to hold accounts at the central bank as commercial banks do today. The US House and Senate have also scheduled hearings, expressing concerns with Facebook’s size and market power.

There are many open questions to discuss further. Here are just a few that come to mind for me:

- What role do Mastercard and Visa and PayPal hope to play as Libra members?

- What are differences and similarities between Libra and Bakkt, the digital currency initiative of Atlanta-based ICE?

- What sort of opportunities might Libra create for an Atlanta firm like BitPay?

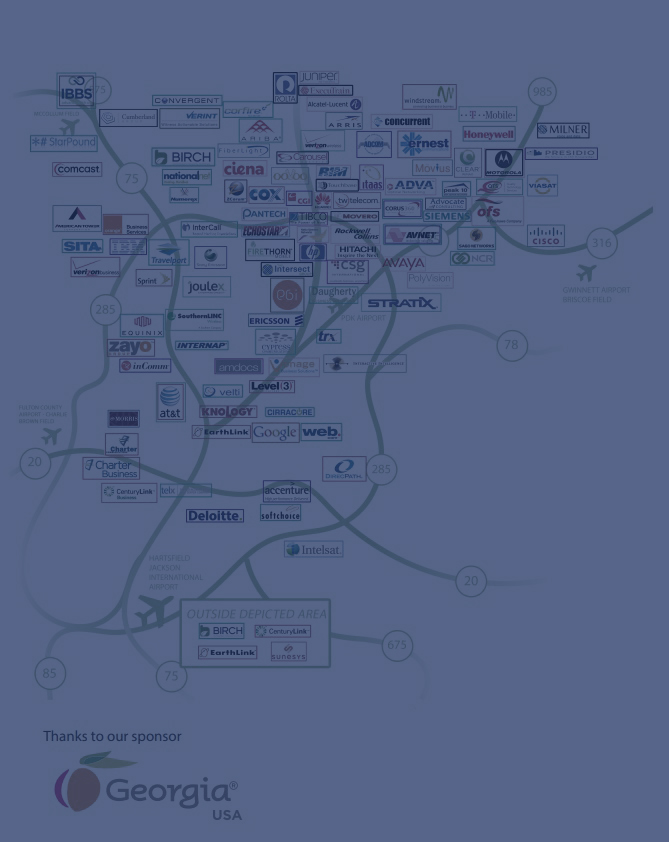

There are many Georgia companies that will have opportunities or challenges presented by Libra’s launch. Check out TAG’s Blockchain Ecosystem Report for a view of many of these companies. In addition, Techcrunch issued a solid overview of Libra which I consulted for some of the above info.

The Libra currency and wallet are slated to launch in 2020, but there will be no shortage of debate before then, and I bet the launch will be delayed well into 2020 due to the regulatory challenges.