Every two years, The Technology of Georgia Fintech Society analyzes the Georgia Fintech ecosystem to assess its veracity and explore its dynamic nature. The Georgia Fintech community, as we know it, can be traced to 1987 when the Georgia Assembly relieved restrictions on credit card rates for banks or credit card operators. Today it encompasses more than 170 FinTech organizations ranging from payment processors to data analytics software providers to accounts receivable financing firms. The breadth and depth of the product offerings is vast.

The beauty of any Fintech analysis is that there is no accepted formal definition of FinTech. The field has no assigned SIC codes and cannot be queried through the Bureau of Labor Statistics. Although we prefer a broad criterion like “the application of technology to financial services,” even this descriptor can lead knowledgeable experts to disagree on which companies and activities qualify.

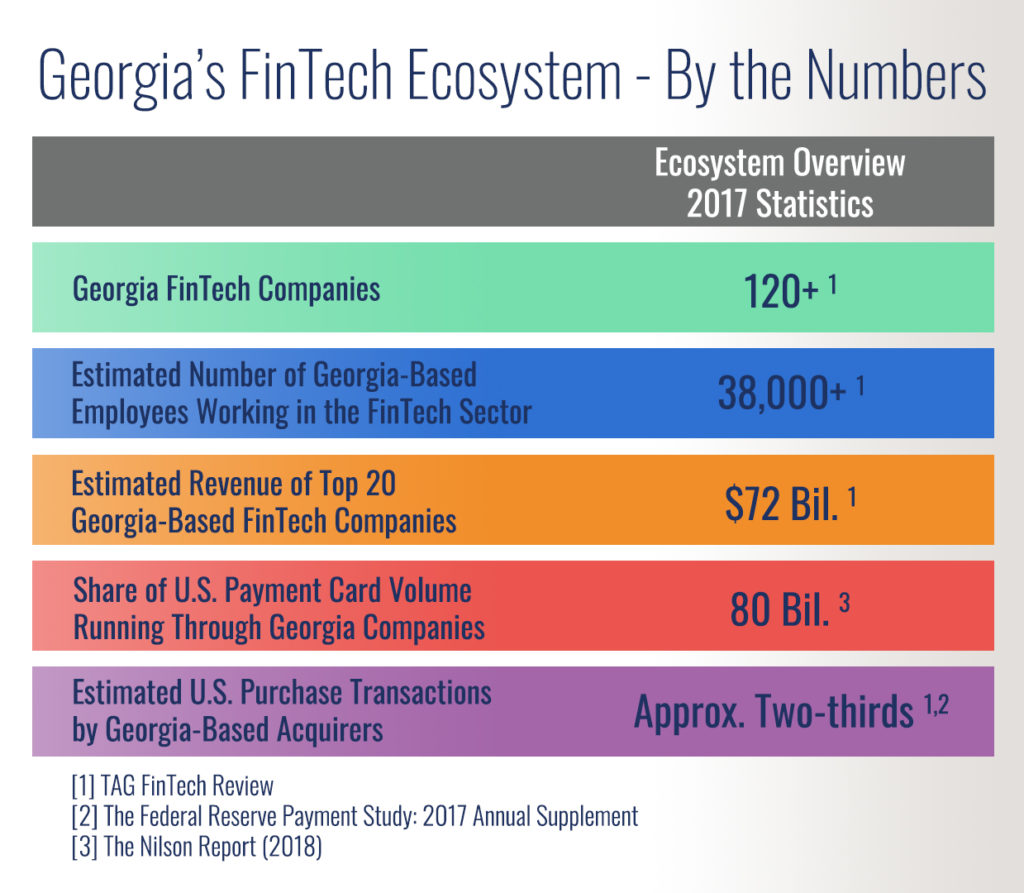

Our estimate of 38,000 Fintech employees in the State of Georgia- based on extensive empirical research, and already more than 5% of the state’s Professional & Business Services workforce – reflects a consciously conservative approach. We have chosen to exclude all supporting professional services (consulting, audit, legal), for instance, as well as the technology teams housed within financial institutions.

Given the multiplier effect of ancillary business activity, Fintech’s influence on the state of Georgia extends well beyond the $72 billion in revenue generated by its 20 largest companies in 2017. Over the past two years TAG’s map of Georgia Fintech ecosystem companies has expanded from 90 to more than 120. This increase reflects healthy startup activity, but also pivots by existing companies to address Fintech business needs, and some cases of existing small companies coming to our attention.

2018 State of Georgia’s Fintech Ecosystem

Content of the 2018 Fintech Ecosystem Report was developed through a collaboration between TAG Fintech and the Financial Services Innovation Lab at the Scheller College of Business at Georgia Tech. A core component of the partnership was a primary research survey of over 100 industry professionals drilling down on the opportunities and obstacles impacting the Fintech community. We are grateful to Sudheer Chava, Director of the Innovation Lab, and his great team of graduate students who coordinated the electronic survey distribution and data analysis.